Data Storage Decoded: Data Warehouse vs Data Lake Explained

Data Analytics in Insurance Sector: Use Cases and Implementation

The traditional insurance industry, once anchored in manual processes, is swiftly being outpaced by technological advancements, making way for data analytics in insurance sector.

With more consumers flocking to digital platforms and data growing exponentially, the pressure to stay ahead is mounting. Insurers who fail to adopt data analytics risk falling behind, while those who embrace it gain a significant edge.

Integrating data analytics allows insurers to gain clearer insights, enhance decision-making, and improve overall efficiency. While the transition may seem complex, adopting the right tools and strategies makes it both achievable and rewarding.

By understanding its value and implementing the right strategies, insurers can utilize analytics to optimize operations and mitigate risks. This enables them to stay ahead in an increasingly competitive landscape.

The Importance of Data Analytics in Insurance Industry

Insurance data analytics involves gathering and analyzing vast amounts of information on policies, claims, and risk profiles to uncover meaningful patterns, trends, and anomalies. By providing deeper insights, it is revolutionizing the insurance sector, enabling smarter decision-making and greater operational efficiency.

Supporting this shift, Fortune Business Insights projects that the insurance analytics market will grow from USD 14.50 billion in 2024 to USD 44.77 billion by 2032. This surge, driven by increasing adoption, represents a CAGR of 15.1%.

This data-driven approach enables insurers to assess risk with greater accuracy and optimize pricing models. It also helps detect potential fraud, resulting in better outcomes for insurers, agencies, and customers alike.

As the insurance landscape becomes increasingly complex, leveraging data analytics allows companies to stay competitive and meet evolving consumer demands.

The answer to “What is the role of data in insurance?” lies in understanding its practical applications. Exploring the uses of data analytics in the insurance industry can help businesses realize its resultant benefits.

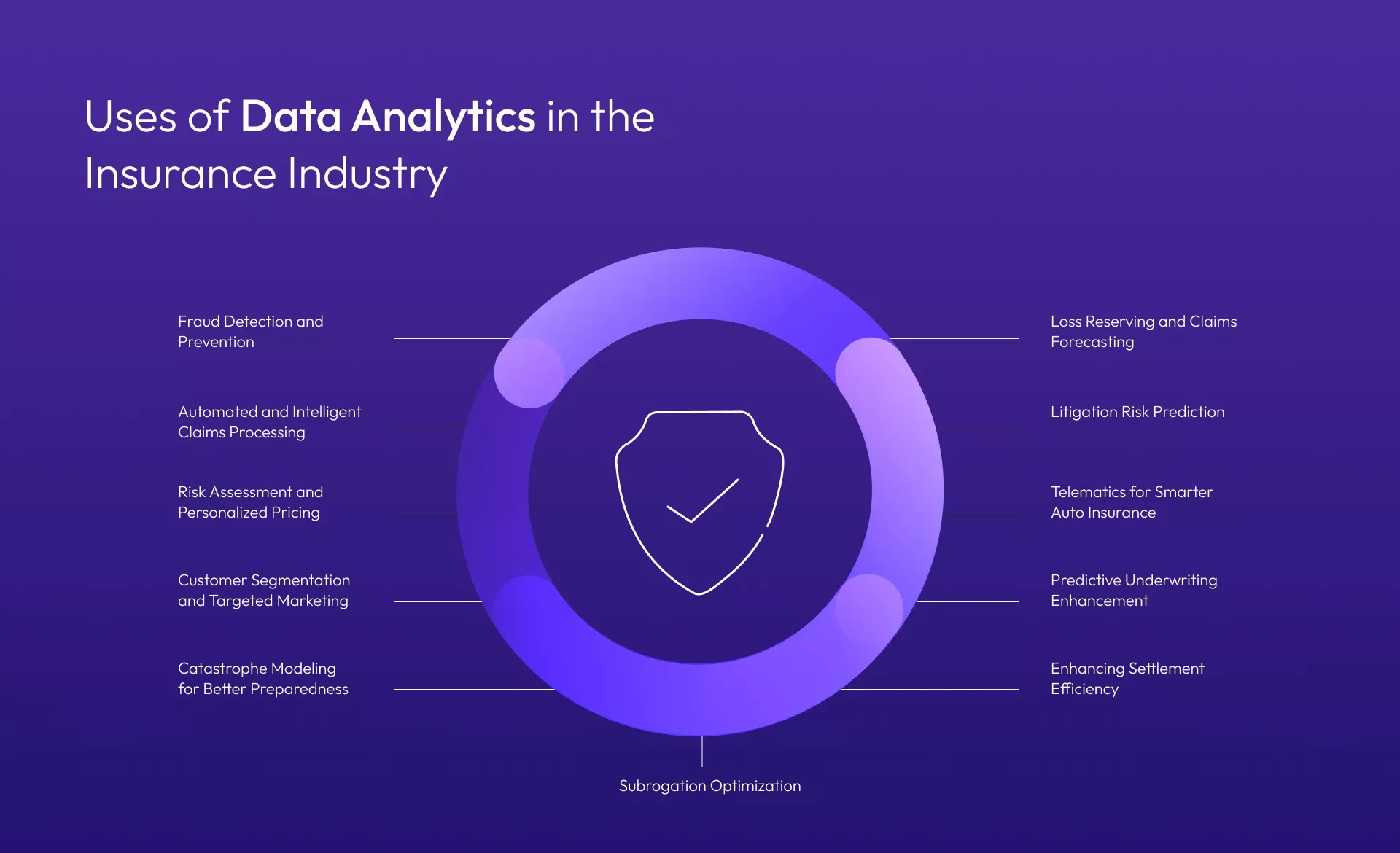

How Is Data Analytics Used in the Insurance Industry?

Data analytics in insurance sector is redefining processes by enabling more precise decision-making, enhancing operational efficiency, and improving customer satisfaction.

Below are some key use cases where insurers can significantly benefit from implementing data analytics:

1. Fraud Detection and Prevention

Fraudulent claims are a major concern for insurers. Traditional fraud detection methods can be slow and ineffective. With data analytics, insurers can:

- Identify anomalies in claim amounts, frequency, and patterns through predictive analytics.

- Leverage text mining to detect deceptive language in claim narratives.

- Use external data sources, like credit scores and previous claim histories, to pinpoint potentially fraudulent claims earlier.

By proactively flagging suspicious claims, insurers can minimize financial losses and protect the integrity of their operations.

2. Automated and Intelligent Claims Processing

Manual claims processing is time-consuming and prone to errors. Data analytics in insurance industry can streamline the process by:

- Automating claims validation using sophisticated algorithms that assess legitimacy instantly.

- Cross-referencing claims with policy records to identify discrepancies or potential fraud.

- Expediting settlement amounts, especially for straightforward claims.

- Implementing automated alerts to notify staff when follow-ups are needed, ensuring timely communication with clients regarding their claims, and addressing any concerns.

- Identifying opportunities for cross-selling and upselling based on claim data, boosting overall customer engagement.

- Automating sales reporting to track producer activities and conversions, offering insights to improve lead assignment. This is based on factors like geographic location, expertise, and potential deal value.

This reduces errors, shortens claims cycle times, and allows adjusters to focus on more complex cases.

3. Risk Assessment and Personalized Pricing

Rather than applying generic pricing, insurers can leverage data analytics to create granular risk profiles based on:

- Historical data on claims and customer behavior.

- Unconventional data sources like social media activity and purchase history.

This enables insurers to tailor premiums more accurately, reducing risks and offering personalized policies that meet individual customer needs.

4. Customer Segmentation and Targeted Marketing

Customer segmentation helps insurers move away from treating all customers as one group. Using data analytics, insurers can:

- Segment by Demographics: Categorize customers based on characteristics such as age, income, lifestyle, and risk appetite.

- Mine Lead Generation Data: Set up reporting from the system of record to extract valuable lead generation data, revealing the customer’s journey from first contact to sale.

- Design Targeted Campaigns: Leverage insights from customer data to create marketing campaigns that resonate with specific segments, for example, offering digital-first auto insurance products to young urban professionals.

- Refine Marketing Efforts: Use the detailed customer journey data to inform and improve future marketing strategies continuously.

- Boost Retention: Personalize service offerings to meet the diverse needs of each segment, ultimately enhancing client retention and satisfaction.

By tailoring offerings to specific segments, insurers can improve customer engagement and drive conversion rates.

5. Catastrophe Modeling for Better Preparedness

Insurance companies face significant risks from large-scale events like natural disasters. Data analytics in insurance sector can help:

- Integrate real-time environmental data, such as oceanic temperatures or deforestation rates, for better catastrophe predictions.

- Predict potential loss areas by analyzing urban development patterns and identifying at-risk regions.

- Refine pricing strategies based on more accurate risk assessments, ensuring that insurers remain financially prepared.

This data-driven approach helps insurers mitigate potential losses by enabling proactive risk management.

6. Loss Reserving and Claims Forecasting

Proper loss reserving is critical to ensuring that insurers can meet future claim obligations. With insurance data analytics, businesses can gain:

- Accurate loss reserving by comparing current claims with similar past cases.

- Dynamic reassessments of reserve levels as claims progress and new data becomes available.

- Improved financial forecasting to ensure sufficient liquidity while preventing over-accumulation of funds.

This helps insurers maintain financial stability and minimize over-reserving, freeing up capital for other investments.

7. Litigation Risk Prediction

Disputed claims lead to costly litigation. By using data analytics in insurance industry, insurers can:

- Calculate a litigation propensity score to determine which claims are most likely to result in legal disputes.

- Assign high-risk cases to senior adjusters with more experience in resolving complex legal issues.

- Reduce legal expenses by settling claims earlier in the process.

This approach helps insurers lower litigation costs and settle disputes more efficiently.

8. Telematics for Smarter Auto Insurance

A key question that often arises is, “What kind of data do insurance companies use?”.

A prime example is telematics in the auto insurance sector. This technology offers insurers real-time, detailed insights into driving behavior, enabling them to:

- Offer personalized premiums based on actual driving patterns, such as speed, braking, and mileage.

- Promote safer driving behaviors by offering rewards for safe drivers, which can further reduce the likelihood of accidents.

- Improve claims accuracy by providing real-time accident data that assists in faster claims resolution.

- Enhance risk assessment and provide more accurate, fair premiums.

9. Subrogation Optimization

Identifying subrogation opportunities, where insurers recover costs from responsible third parties, can be challenging due to the volume of data involved.

Here, text analytics can help by:

- Scanning unstructured data like that in medical records to identify potential subrogation cases.

- Automating the identification process, ensuring that opportunities are flagged early and accurately.

This allows insurers to maximize recovery and reduce claim-related expenses.

10. Enhancing Settlement Efficiency

Fast and fair claim settlements are key to customer satisfaction. Data analytics in insurance sector can:

- Optimize settlement thresholds, ensuring that claims are processed quickly while preventing overpayment.

- Streamline settlement for natural disasters or other large-scale events by analyzing claims data for trends and insights.

- Ensure fairness in settlements by providing more accurate data on claim validity.

11. Underwriting Enhancement through Predictive Analytics

Traditionally, underwriting relied on static tables and limited historical data. However, with the advent of data analytics, insurers can gain a deeper, more nuanced understanding of risk.

Using advanced algorithms, insurers now analyze vast amounts of data. Its applications include both conventional sources, like police reports, and modern ones, like telematics in auto insurance.

This approach helps to:

- Predict future risks more accurately by identifying patterns in data.

- Tailor premiums based on factors such as lifestyle, exercise habits, or even genetic predispositions, moving beyond basic demographic information.

- Enhance the overall accuracy of underwriting decisions, allowing for more personalized policies.

As artificial intelligence (AI) and machine learning continue to evolve, their influence on data analytics in insurance underwriting is set to expand, further driving efficiency and precision across the process.

The growing role of AI in automating insurance tasks like underwriting and claims management is reshaping the way insurers approach risk assessment, a trend that will only accelerate in the coming years.

How to Successfully Implement Data Analytics in Insurance Sector?

Implementing data analytics in insurance industry requires a structured, strategic approach to ensure optimal results.

From defining key business challenges to leveraging advanced analytics for decision-making, insurers can follow a step-by-step framework to realize the full potential of data.

1. Define the Business Problem

The foundation of a successful data analytics implementation begins with problem framing. Insurers must clearly identify the key challenges they aim to address, such as optimizing premium pricing, detecting fraud, predicting policyholder churn, or improving claims processing.

A well-defined problem statement aligns analytics efforts with business objectives, ensuring that the insights generated are actionable and relevant.

2. Data Collection and Integration

Data serves as the backbone of analytics-driven decision-making in the insurance industry.

Insurers must aggregate data from various sources, including:

- First-party data: customer profiles, historical claims, policy details

- Second-party or external data: market trends, demographic insights

Integrating data from legacy systems, IoT devices, and third-party sources enables insurers to develop a comprehensive understanding of several key factors. These include risks, customer behaviors, and operational efficiencies, a better understanding of which will enhance decision-making.

3. Data Preparation and Quality Assurance

Raw data is often unstructured, incomplete, or inconsistent. To derive meaningful insights, insurers must process and refine their datasets. This stage involves:

- Data Extraction: Retrieving data from legacy systems and multiple repositories.

- Data Cleaning: Removing inconsistencies, duplicates, and errors to ensure accuracy.

- Data Structuring: Standardizing formats and handling missing values for seamless analysis.

Quality data is essential for reliable outcomes in data analytics within the insurance sector. It helps prevent biases and inaccuracies in risk assessments, claims predictions, and fraud detection models.

4. Advanced Analytics and Model Development

Once the data is structured, insurers can apply various analytical techniques to generate actionable insights:

- Descriptive Analytics: Identifies past trends in claims, policies, and customer behaviors.

- Diagnostic Analytics: Examines underlying reasons behind key business trends, such as rising claim costs or customer attrition.

- Predictive Analytics: Forecasts future trends, such as policyholder risk levels, fraud likelihood, and expected claims volume.

- Prescriptive Analytics: Recommends actions to mitigate risks, improve customer engagement, and optimize underwriting models.

Machine learning and AI-powered models play a crucial role in automating predictions, enhancing accuracy, and enabling real-time decision-making in risk assessments and pricing strategies.

5. Insights Visualization and Reporting

Effective data visualization and reporting help insurers present complex analytics results in a simplified, intuitive format. Interactive dashboards and real-time reports enable underwriters, claims professionals, and other stakeholders to identify trends quickly, assess risks, and make informed decisions.

Advanced analytics platforms play a key role in this process.

- Tableau, widely used in the insurance sector, simplifies data visualization, helping insurers quickly assess risk, detect patterns, and refine policy pricing. Its real-time dashboards also enhance customer engagement by providing insights into policyholder behavior.

- Another platform, Power BI, offers a comprehensive view of operations through interactive reports and performance tracking. This, resultantly, enables insurers to monitor claims processing efficiency and optimize customer service.

Choosing the right BI tool can help insurers ensure that data-driven insights are accessible, actionable, and effectively utilized across departments.

6. Continuous Evaluation and Optimization

The effectiveness of data analytics initiatives should be regularly assessed to ensure ongoing improvements. Key considerations include:

- Measuring the impact of analytics-driven decisions on profitability, efficiency, and customer satisfaction.

- Identifying gaps or unexpected trends that require further analysis.

- Refining models and strategies to adapt to evolving market conditions and regulatory requirements.

By establishing a continuous feedback loop, insurers can enhance their analytics frameworks, improve predictive accuracy, and maintain a competitive edge in the evolving insurance landscape.

Final Thoughts

By weaving AI and data analytics in insurance sector, businesses can cut costs, speed up claims, and make smarter decisions that set them apart.

With competition getting fiercer and customers expecting more, relying on data-driven insights isn’t just about keeping up; it’s about staying ahead.

And while adopting new technology might seem daunting, the right tech partners can make the transition seamless. With their support, insurers can unlock real value and build a future-ready business.

Email us or Talk to us at +91-98367-81929 or Simply Contact Us through the website.

Let's Connect