Data Storage Decoded: Data Warehouse vs Data Lake Explained

The Future of AI in Insurance: Paving the Way for Smarter Solutions

As automation redefines how we live and work, AI in insurance is transforming the industry by simplifying complex tasks like data analysis, fraud detection, and underwriting.

With its unparalleled ability to process massive amounts of information, AI is helping insurers streamline operations and deliver faster, smarter, and more personalized solutions.

In a world of rising customer expectations and increasingly sophisticated fraud, artificial intelligence is the industry’s answer to staying competitive.

With nearly 80% of principal agents embracing AI platforms, the message is clear: the future of insurance is AI-driven.

This transformative technology is not just keeping pace with change; it’s leading the way to a smarter, more seamless insurance experience.

But, how?

Find out here.

Why Should AI Be Used in Insurance?

AI is reshaping the insurance industry by introducing smarter, faster, and more efficient ways to manage operations.

What makes AI adoption even more appealing is its ease of integration. With insurance professionals already accustomed to low-code and no-code platforms, AI-powered tools like virtual assistants and automated workflows are quickly becoming indispensable.

ROI of AI in Insurance:

- Cost Savings: Automating repetitive tasks, like customer data validation, regulatory report generation, and account closure, reduces operational costs and minimizes human errors.

- Faster Claims Processing: AI-driven automation speeds up claims handling by managing data entry, policy retrieval, damage assessment, document verification, and status updates, improving customer satisfaction and retention.

- Enhanced Fraud Detection: Advanced algorithms detect suspicious patterns and mitigate fraudulent claims before they escalate.

- Personalized Customer Experience: AI analyzes customer data to offer tailored policy recommendations and proactive, round-the-clock support, resulting in faster resolutions and improved customer experiences.

- Operational Efficiency: Streamlining workflows allows insurance professionals to focus on high-value tasks and strategic decisions.

How Is AI Being Used in Insurance?

There are several applications of AI in the insurance industry that businesses can tap into. Here are the top ones among them:

Smarter Underwriting and Risk Decisioning

The pressure to speed up underwriting decisions is mounting.

But, it also comes with modern challenges like digital fraud, which needs AI intervention to be tackled while enhancing decision-making speed and accuracy.

AI unifies data from diverse sources, detects fraud patterns through advanced learning techniques, and leverages network detection models to uncover connections. These insights help underwriters mitigate fraud, optimize pricing, and assess risks before issuing policies, offering a clear perspective on how AI is used in policymaking.

Key Benefits:

- Enhanced Customer Experience: Achieve the perfect balance of speed and accuracy in underwriting decisions.

- Fraud Prevention: Mitigate premium leakage and combat sophisticated digital fraud threats.

- Pricing Optimization: Prevent unnecessary premium increases while ensuring competitive pricing.

- Operational Efficiency: Support underwriting teams with actionable insights, streamlining processes and boosting efficiency.

Faster, Smarter, and Fairer Claims

Claims management is one of the most high-volume and redundant tasks that can easily be tackled better with AI in the insurance industry.

Here’s how:

- Increased Speed: With the ability to analyze data quickly, AI streamlines claim reviews and predicts potential costs, cutting down on processing time without compromising accuracy.

- Operational Savings: Automating repetitive manual tasks reduces costs and minimizes claims losses.

- Higher Efficiency: Agents can focus on more complex tasks, improving overall efficiency.

- Better Customer Experience: By automating routine tasks and offering insights from data analysis, AI ensures consistency across claims, enhancing transparency and fairness for policyholders.

Protection against Fraud

Insurance fraud costs the industry a staggering $308 billion annually. AI can help save insurers from this nightmare by offering the following:

- Speed and Precision: AI tools can identify doctored documents, reused photos, and other signs of fraud. This, in turn, removes suspicious claims with greater accuracy from the automated process for further investigation.

- Better Insights: By analyzing claims data and flagging inconsistencies across systems, AI eases fraud detection, enabling insurers to act faster than ever before.

- Cost Savings: Insurers can protect their bottom line and improve profitability by preventing payouts against fraudulent claims.

- Competitive Pricing: Avoid increasing premiums to offset fraud.

Detection of Subrogation Opportunities

A significant portion of P&C claims are closed without taking full advantage of subrogation opportunities, resulting in missed recoveries for insurers.

By applying AI-powered strategies, insurers can recover more from claims by efficiently identifying opportunities that might otherwise be overlooked.

Key Benefits:

- Reduced Claim Losses and Improved Deductible Recovery: AI technology enhances subrogation detection by quickly analyzing claims and pinpointing areas for recovery, reducing claim losses and improving deductible recovery.

- Enhanced Team Efficiency: Resultantly, less experienced teams are empowered to drive greater results, while experienced teams can focus on resolving more complex claims.

Improved Customer Service

Customer service can be time-consuming, but AI in insurance makes it more efficient by addressing common inquiries and providing essential information at any time.

Key Benefits:

- Always-On Support: Chatbots and virtual assistants deliver instant, 24/7 support, enhancing customer satisfaction and driving loyalty.

- Personalized Interactions: Virtual assistants can even handle complex tasks, from answering advanced questions to initiating claims and tailoring recommendations and responses to each customer.

- Streamlined Service: Automate routine queries and claims processes.

- Intelligent Learning: Machine learning continually improves the AI’s ability to recognize patterns and make smarter decisions.

Risk Mitigation

AI is reshaping risk prevention by analyzing vast amounts of data to predict and prevent future issues.

Key Benefits:

- Proactive Risk Identification: AI can even analyze IoT data and past claims to identify early warning signs, helping insurers understand a client’s risk profile and anticipate future concerns.

- Tailored Solutions: AI offers personalized advice and proactive measures, enabling insurers to tackle risks before they become costly.

- Smarter Forecasting: By processing historical claims, customer demographics, insurance market trends, and environmental data, AI gives insurers the ability to assess risks and forecast potential losses more accurately.

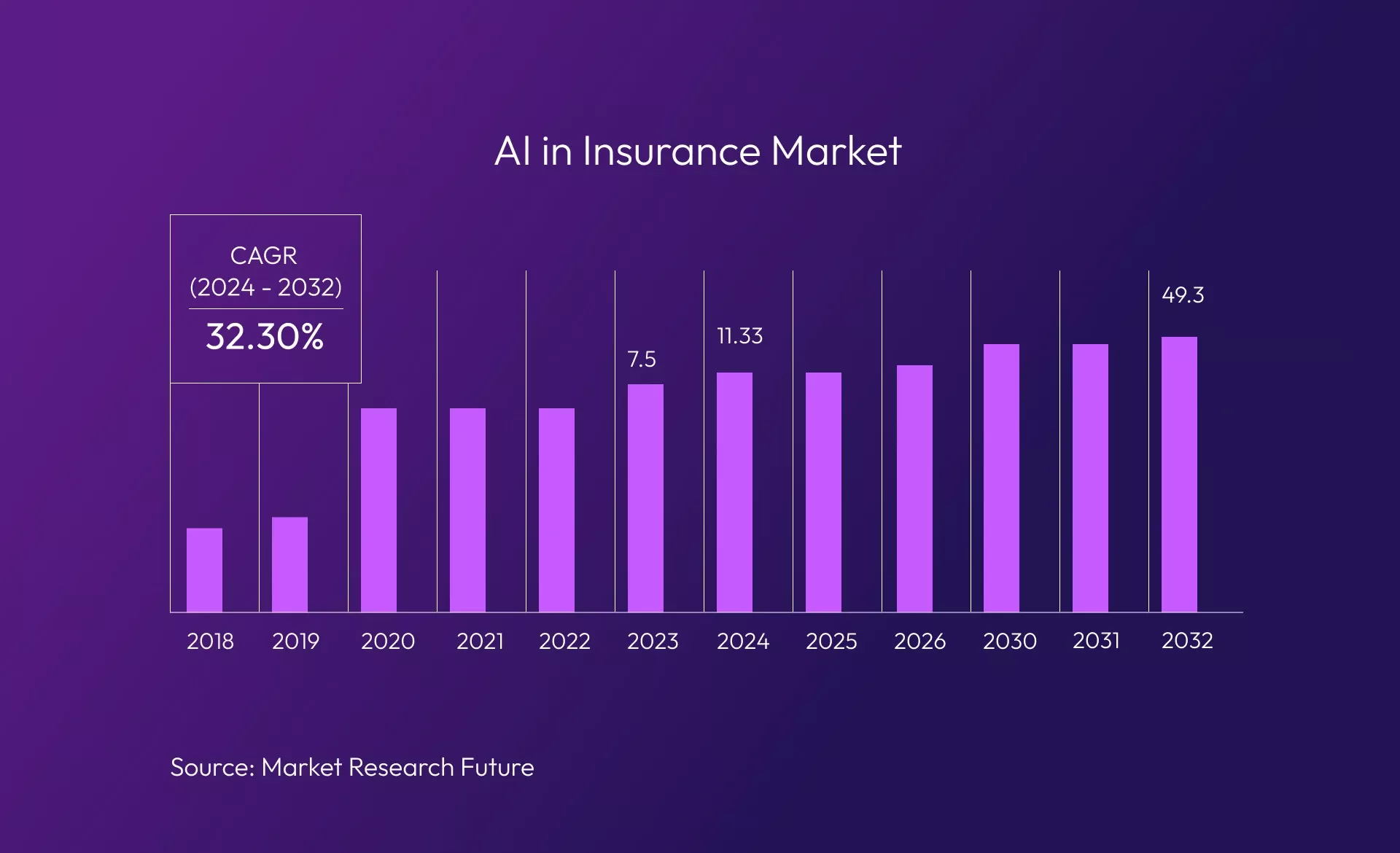

Future Outlook of AI in the Insurance Industry

The insurance industry stands at the cusp of a major transformation, with AI adoption set to skyrocket from $11.33 billion in 2024 to $49.3 billion by 2032. To stay ahead, insurers must move beyond traditional methods and adopt AI-driven strategies.

AI in insurance has already redefined efficiency and profitability, and its influence will only deepen.

The focus is no longer on whether AI will reshape the industry but on how fast insurers can leverage its potential to thrive.

Now, if you are wondering, “Will AI replace insurance adjusters?”. The answer is, probably not!

At Sundew, we believe that while technology fuels progress, people drive true innovation.

However, while many processes still require human oversight, the potential for full workflow automation in insurance and home warranty is closer than ever.

By integrating AI as a trusted partner rather than a replacement, insurers can strike the right balance between automation and human expertise.

Our experts are committed to responsible AI adoption, ensuring its implementation is ethical, transparent, and aligned with business goals. With our strategic approach, enterprises can confidently harness AI and accelerate value creation in the insurance sector.

Email us or Talk to us at +91-98367-81929 or Simply Contact Us through the website.

Let's Connect