The Power of Data Visualization Using Tableau

Trends in Financial Services: How Fintech is Transforming Banking

Fintech is transforming banking by improving access for underbanked and unbanked populations, offering affordable digital services where traditional banks fall short. This primary driver of the latest trends in financial services is closing gaps in financial inclusion and revitalizing legacy systems.

In 2021, 13% of Americans lacked full banking access, with 5% having no services at all. Fintech has changed this landscape over the last 4 years by reducing costs and providing digital options like direct deposits, making banking more accessible and affordable.

To stay relevant, banks must rethink their strategies and embrace the growing trend of embedding financial services into products and apps. By doing so, they can not only enhance customer engagement but also tap into new revenue opportunities and maintain their relevance in an increasingly interconnected digital ecosystem.

So, how is fintech reshaping the future of banking by driving both financial inclusion and business growth?

Find out in these latest developments.

What Are the Emerging Trends in Financial Services?

By integrating mobile payments, lending, and investment tools directly into their platforms, businesses can unlock fresh revenue streams, strengthen customer loyalty, and stay ahead of the competition.

Let’s take a look at the financial services trends reshaping the banking technology landscape in 2025.

Digital-Only Banking

The steady decline in cash usage, coupled with the rollout of central bank digital currencies (CBDCs), has led to the recent digital trends in financial services. Digital currencies are rapidly gaining traction across B2C, B2B, and C2C segments, further fueling the shift toward cashless transactions.

Digital-only banks, or neobanks, are ruling this change as technology modernization makes the banking services more convenient and efficient. These changes make the entire banking sector more popular and accessible than ever.

Operating entirely online, they offer:

- Increased Convenience: Digital banking eliminates the need for physical visits, allowing users to manage accounts anytime, anywhere.

- Cost Savings: Lower fees and reduced operational costs make neobanks an attractive choice for consumers and businesses alike.

- Wider Accessibility: Cashless solutions and digital currencies enable broader participation, even in previously underserved markets.

- Improved Customer Experience: Seamless interfaces and efficient processes enhance satisfaction and loyalty.

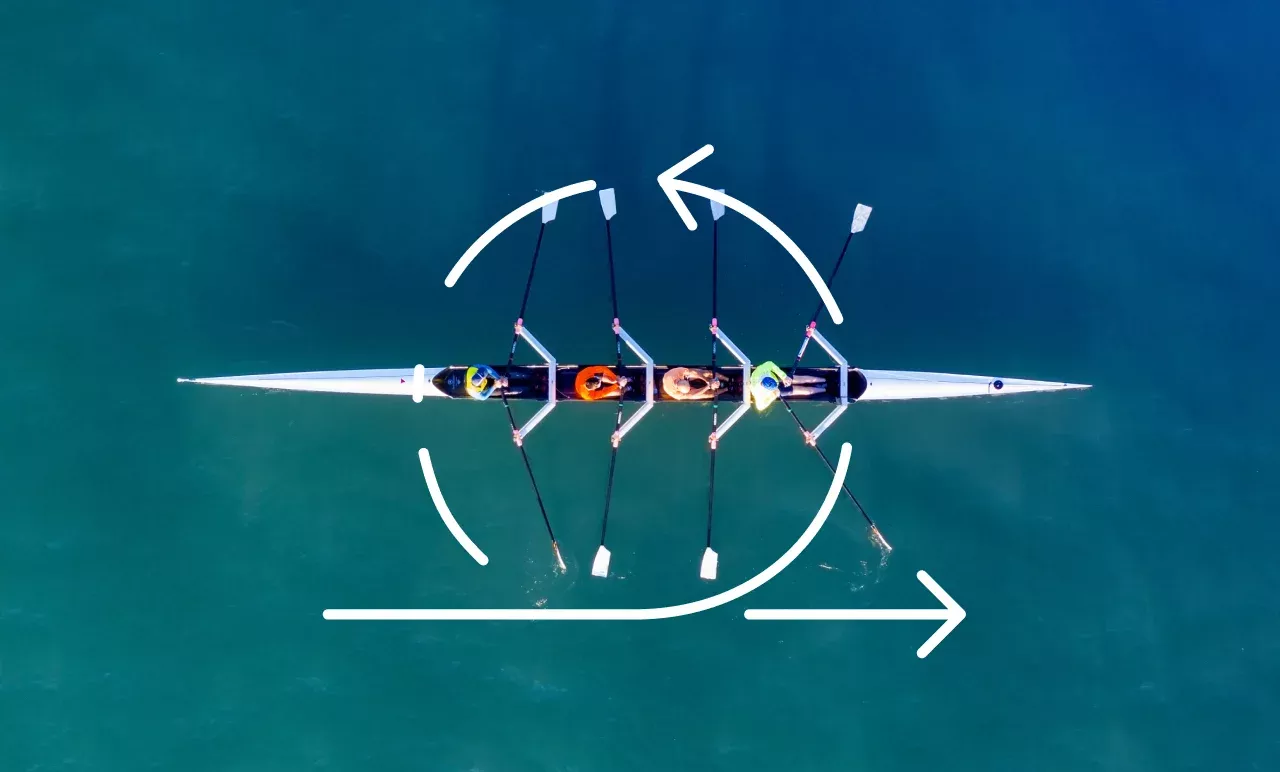

Banking-as-a-Service using Embedded Finance

You’ve heard of SaaS, but it’s time to discover the next big thing in fintech: BaaS or Banking-as-a-Service.

In 2025, embedded finance is one of the global financial trends that is set to redefine the financial landscape. It will do so by integrating essential financial services like payments, lending, and insurance directly into non-financial platforms.

Banking-as-a-Service (BaaS) is the catalyst behind this shift, enabling banks to extend their services to third-party businesses.

With BaaS, e-commerce platforms can offer:

- Enhanced Convenience: Embedding financial services directly into platforms during checkout streamlines user interactions and eliminates extra steps.

- New Revenue Streams: BaaS unlocks new opportunities for revenue generation and market expansion for banks and businesses.

- Broader Customer Reach: Companies can access new, untapped market segments through embedded finance.

- Personalized Offerings: Tailored financial solutions meet unique user needs, driving engagement and loyalty.

- Innovation Enablement: By partnering with banks through BaaS, businesses can focus on core competencies while leveraging robust banking capabilities.

Personalized Banking

As customer expectations evolve, personalized banking is emerging as a critical differentiator.

By the end of this year, advanced data analytics and AI will empower banks to deliver tailored financial services, such as customized savings plans and investment advice. These automated customer solutions will create a more seamless and efficient banking experience.

By the end of this year, advanced data analytics and AI will empower banks to deliver tailored financial services, such as customized savings plans and investment advice.

This shift aligns with the booming personal finance app market, which is projected to grow from $1.02 billion in 2021 to $12.58 billion by 2034.

Leveraging user data, banks can offer:

- Enhanced Customer Engagement: Tailored services make customers feel valued, fostering loyalty and trust.

- Proactive Financial Guidance: AI-driven insights based on spending patterns help users make informed decisions. This can include suggesting mortgage options and offering financial wellness tools.

- Increased Retention: Meeting individual needs reduces churn and strengthens customer relationships.

- Market Competitiveness: Personalized offerings set banks apart in a crowded fintech landscape.

Buy Now, Pay Later (BNPL)

BNPL is gaining momentum as one of the top trends in financial services industry, with 29% of consumers using it in the past year and millennials leading the way. As demand grows across age groups, BNPL transaction volumes are projected to hit $680 billion globally by 2025.

With 80% of BNPL users starting their shopping journey on provider platforms, banks, and fintech companies have a prime opportunity to integrate BNPL services to offer:

- Increased Customer Conversion: Flexible payment options encourage higher sales and reduce cart abandonment.

- Improved Customer Loyalty: Offering BNPL fosters trust and satisfaction, especially with budget-conscious shoppers.

- Expanded Revenue Streams: BNPL opens new monetization opportunities for banks and financial institutions through transaction fees and interest.

- Broader Market Appeal: With demand spanning all age groups, BNPL enables businesses to attract a diverse customer base.

- Regulatory Readiness: Staying compliant with evolving laws ensures sustained growth in this lucrative sector.

However, evolving regulations in the EU and the US mean fintechs must stay ahead of compliance requirements to capitalize on this market.

Real-Time Payments (RTP)

The payment landscape is set to transform further in 2025 as consumers demand faster, smarter, and more seamless payment options.

Real-time payments (RTP), enabling 24/7 money transfers, are becoming the standard. Innovations like blockchain for cross-border payments and biometric-enabled transactions are redefining convenience and security.

Valued at $17.57 billion in 2022, the RTP market is projected to grow 35.5% annually through 2030, primarily owing to the following beneficial outcomes:

- Enhanced Speed and Accessibility: RTP enables instant money transfers 24/7, meeting the demand for always-on convenience.

- Improved Security: Innovations like blockchain and biometrics bolster transaction security, increasing consumer confidence.

- Higher Customer Satisfaction: Faster and smarter payments align with user expectations, boosting loyalty and engagement.

- Global Reach and Efficiency: Real-time cross-border payments minimize delays and reduce transaction costs for international transfers.

ESG (Environmental, Social, and Governance) Banking

As sustainability continues to rise as one of the trends in financial services, the spotlight on Environmental, Social, and Governance (ESG) factors intensifies.

In 2025, banks will be under increasing pressure to showcase stronger ESG initiatives, ranging from sustainable financing and green bonds to responsible lending practices.

With consumers eager to invest in alignment with their values, banks that embrace sustainability will gain a competitive edge in the following ways:

- Attracting Conscious Consumers: Meeting the demand for sustainability-focused investments fosters stronger customer loyalty.

- Strengthened Compliance and Transparency: As regulations around ESG disclosures tighten, banks will need to enhance their reporting systems to ensure transparency and compliance.

- Unlocking New Opportunities: Green bonds and sustainable financing open doors to innovative revenue streams.

- Boosting Brand Reputation: Demonstrating a commitment to ESG enhances public perception and attracts socially responsible investors.

Added Emphasis on Cybersecurity and Data Privacy

Online data security isn’t just one of the recent trends in financial markets; it’s an indispensable necessity.

As reliance on digital banking continues to grow, so does the innovation in cyber threats.

Every day, customers find themselves stuck in newer and more creative data scamming traps. This makes protecting sensitive information and securing customer transactions a non-negotiable for banks in 2025.

To stay ahead, financial institutions must ramp up investments in cutting-edge cybersecurity solutions, such as:

- AI-driven threat detection

- Biometric authentication

- Multi-factor authentication (MFA)

At the same time, stringent privacy regulations like GDPR and CCPA require banks to enhance data protection and maintain transparency.

Failing to meet privacy standards or experiencing a breach can damage a bank’s reputation and customer trust, making cybersecurity investments more critical than ever.

Blockchain in Banking

Another one of the notable trends in financial services is blockchain. It is leading the way by promoting a decentralized, secure ledger system, streamlining identity verification, and reducing fraud risks.

Key use cases include:

- Trade Finance: Secure, traceable documentation for international trade.

- Cross-Border Payments: Faster, cheaper payments by removing intermediaries.

- Smart Contracts: Automated, transparent agreements without third parties.

- KYC Compliance: Simplified, decentralized identity verification for better compliance.

- Supply Chain Finance: Transparent records for efficient financing.

With countries like Nigeria and the Bahamas implementing CBDCs and others exploring them, blockchain is set to further reshape global financial systems.

Generative AI in Banking

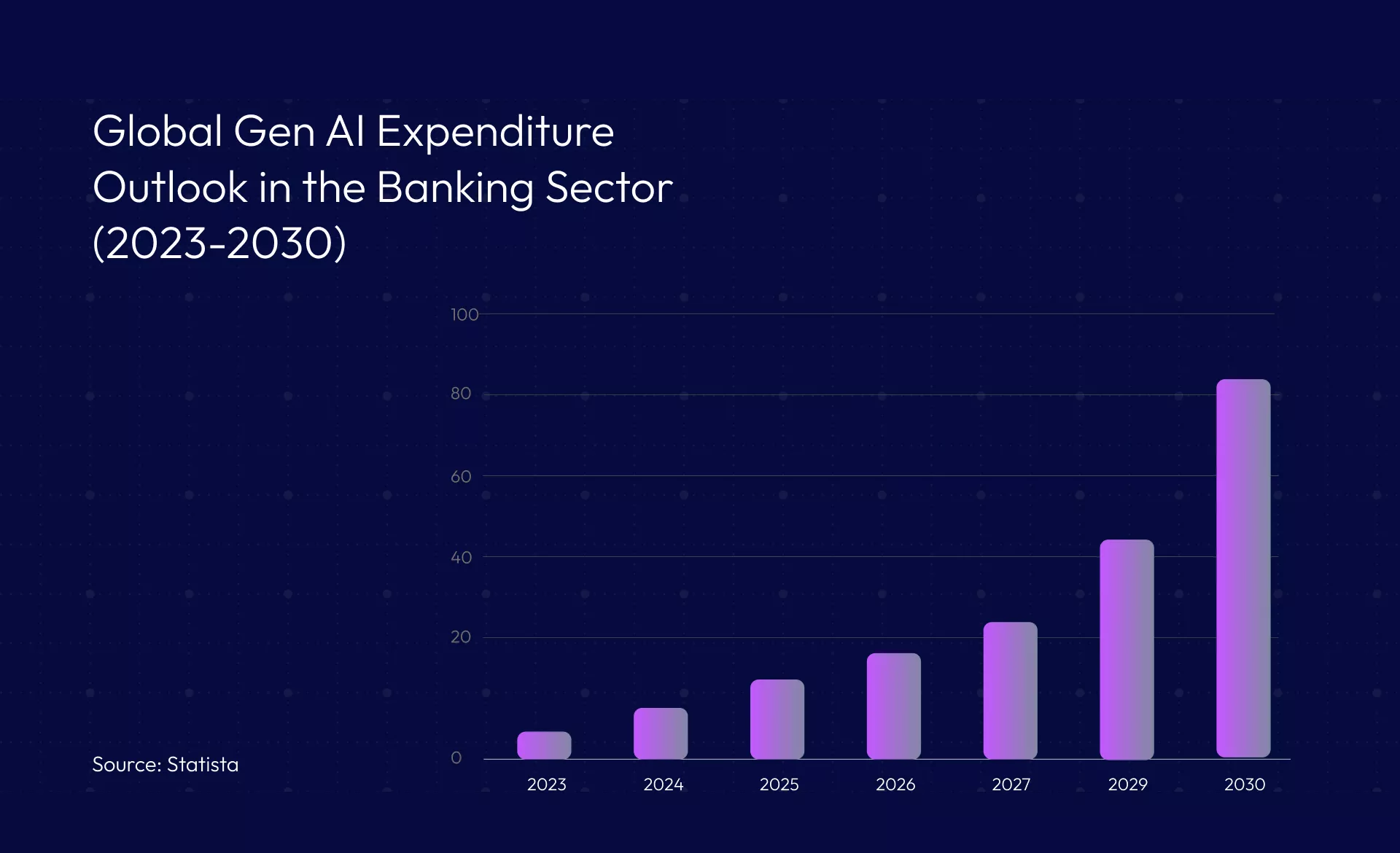

Statista reveals that the banking sector led AI investments in 2023, dedicating $20.6 billion to transform its operations. This figure is projected to soar to $84.99 billion by 2030.

Generative AI (GenAI) has the potential to add tremendous annual value to this. It achieves this primarily by automating tasks like data entry, report generation, and compliance checks, thereby enhancing operational efficiency.

Here are some ways in which GenAI can benefit the banking and finance industry:

- Dynamic Fraud Prevention: GenAI can analyze patterns in real-time to detect potential fraud, significantly reducing financial risks.

- Improved Credit Assessment: By processing vast data sets, GenAI provides more accurate credit scores and risk assessments, enabling better lending decisions.

- Enhanced Customer Service: AI-driven chatbots deliver personalized, 24/7 support, improving customer engagement and satisfaction.

- Tailored Financial Advice: GenAI analyzes individual financial histories to offer customized investment strategies and savings plans. Over a third of consumers are considering AI for financial advice and planning.

- Predictive Banking: AI-powered predictive analytics enable banks to anticipate customer needs and deliver proactive services such as cash flow prediction and personalized investment opportunities. These capabilities improve customer retention.

Redefining Compliance with Regulatory Shifts

The regulatory landscape for banks is set to transform in 2025, driven by an intensified focus on data privacy, cybersecurity, and sustainability.

As a result, financial institutions can achieve the following outcomes:

- Enhanced Efficiency: Automated reporting systems streamline compliance processes, reducing manual effort and the risk of errors.

- Improved Consumer Protection: With digital banking, cryptocurrency, and blockchain at the forefront, new frameworks are being introduced to enhance consumer protection and financial stability.

- Strengthened Cybersecurity: AI-driven compliance tools help identify and mitigate potential security risks, ensuring robust protection against cyber threats.

- Increased Trust and Resilience: Proactive compliance fosters trust with customers, regulators, and investors, strengthening the institution's reputation.

- Future-Proofing: Adopting innovative compliance solutions helps banks stay ahead of evolving regulations and market demands.

What is the future of the financial services industry?

The fintech industry is at a pivotal juncture where innovation and adaptability are reshaping how financial services are delivered.

However, getting on with evolving trends in financial services isn't just about competing with traditional banks - it's about transforming finance to serve everyone better.

Through responsible innovation, fintech is paving the way for a more inclusive, efficient, and customer-centric financial ecosystem.

Businesses looking to lead this transformation can leverage Sundew’s expertise in technology-driven solutions to reimagine their services. With our strategic partnership, organizations can harness innovation to build trust, unlock growth, and deliver financial services that drive prosperity for individuals and communities alike.

Email us or Talk to us at +91-98367-81929 or Simply Contact Us through the website.

Let's Connect